They’re here!—our all new eBanking and mBanking services.

Thanks again to all of you who took the time to complete our website survey last fall. We’ve been working hard to incorporate your requests into our updated services. We think you’re going to love the end result.

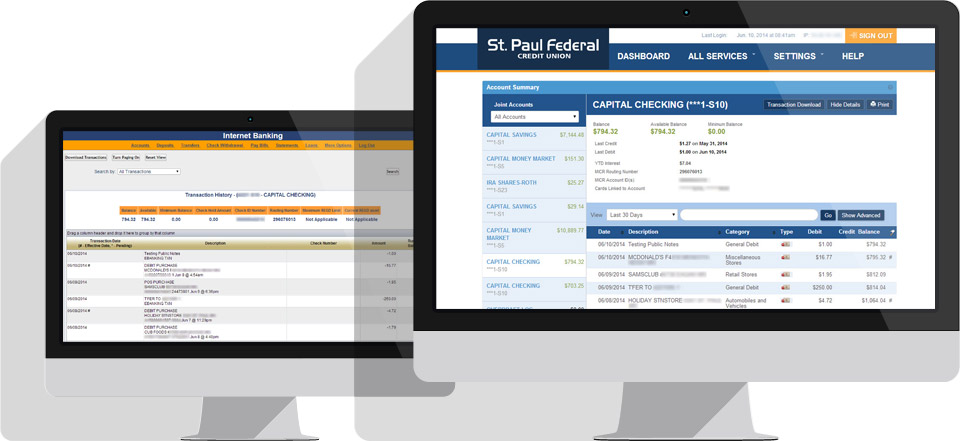

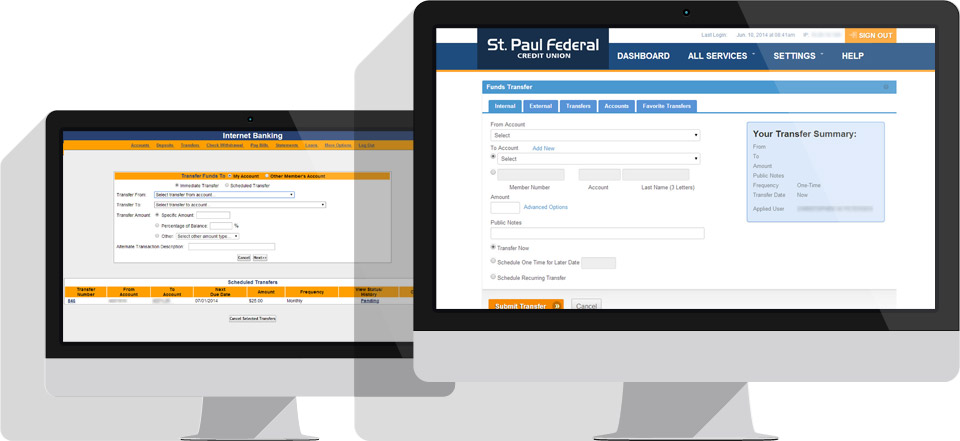

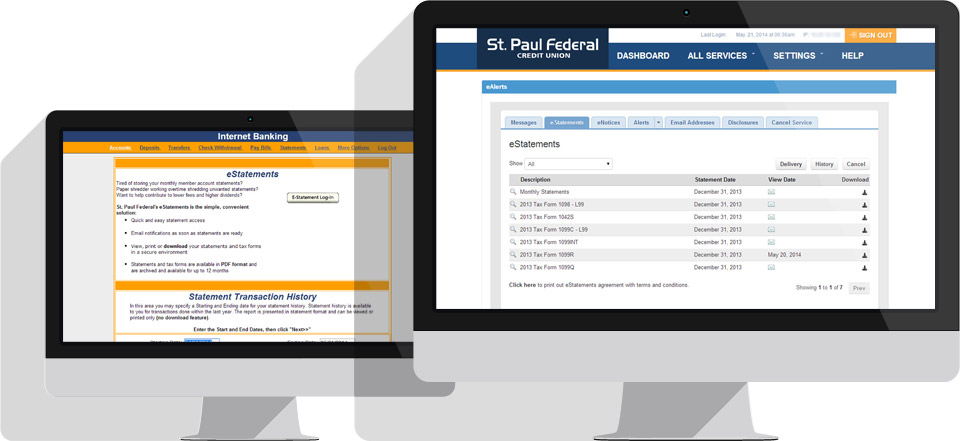

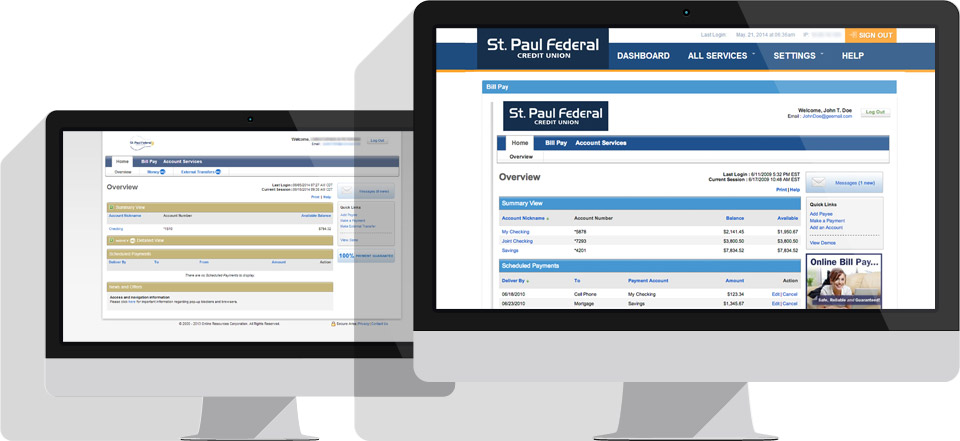

Here’s a comparative view of the changes we’ve made.

1. You wanted a better dashboard view of accounts and loans.

We provided an updated single page format with simplified access to more detailed information.

2. You wanted access to all of your account balances on a single page, with simplified navigation and no additional login requirements.

We grouped all of your account balances into an easy-to-access, at-a-glance Dashboard format.

3. You wanted up-to-the-minute account information and easier navigation to all account services.

We provided multiple transaction options and details in an at-a-glance format, as well as provided quick links to all available services from the new menu system.

4. You wanted more streamlined processes and more prominent action buttons.

We provided new Dashboard Widgets for quick access, as well as full modules to perform all of the tasks you need. All with easy to identify and activate action buttons.

5. You wanted easier access to past statements and other electronic documents.

We provided easy-to-navigate access to your eStatements, eNotices, eAlerts, eMessages, and more.

6. You wanted larger font sizes and an updated, more visual appeal.

We increased usable page space and added bold headings.

7. You wanted seamless navigation to bill pay services with no additional login requirements.

We provided single login access with easy navigation between your accounts and Bill Pay services.

8. You wanted seamless navigation to your Credit Card Transaction Data (EZCard Info) with no additional login requirements.

We provided single login access with easy navigation between your accounts and the EZCard Info Services.

The new eBanking and mBanking services will require you to re-enroll for our services, but will provide many additional features and benefits.

Here are some of the additional features not highlighted above:

| Transfer Funds between your St. Paul Federal Credit Union accounts and between your accounts with the credit union and other financial institutions. |

| Deposit Checks using a flatbed scanner, Canon® check scanner, or your mobile device. |

| Download iPhone® and Android® mobile apps. |

| Receive Account Alerts via email or SMS for transactions, reminders, or any other personal alerts you may want to set up. |

| Access Money Desktop, our new Personal Financial Management Service, to track transactions, create budgets, track your overall financial health, and aggregate your account information from all of your financial institutions into one location. |

| Send eMessages securely to St. Paul Federal Credit Union. |

| Use Document Cabinet to view copies of your transaction receipts, statements, and more. |

| View Your Rewards Status in our Simply Checking Bonus Dividend checking rewards program. |

| Open Accounts online in real-time—Savings, Checking, Money Market, or Investment Accounts. |

| Apply for Personal Loans and have all of your data automatically pre-filled using our new Loan Application feature. |

| Stop Payments Instantly on a check you have written. |

| Access Tax Details for your current and prior year dividends earned and interest paid on your accounts. |

| Order Checks by placing an order from within eBanking. |

| Skip A Payment any time of the year by automatically selecting our Skip A Payment benefit that will be processed within eBanking. |

| Add Secondary Users to your eBanking Services. Primary account holders can create as many secondary users as needed and provide granular permissions to each secondary user. |

All features and services may not be immediately available on launch, and may be subject to qualification before usage.