St. Paul Federal Credit Union Checking Advantages

St. Paul Federal Credit Union offers Simply Checking, an interest-bearing checking account with no minimum balance requirements.

Advantages of Simply Checking

Free VISA® ATM/Debit Card

Access to cash Worldwide using any ATM that accepts VISA

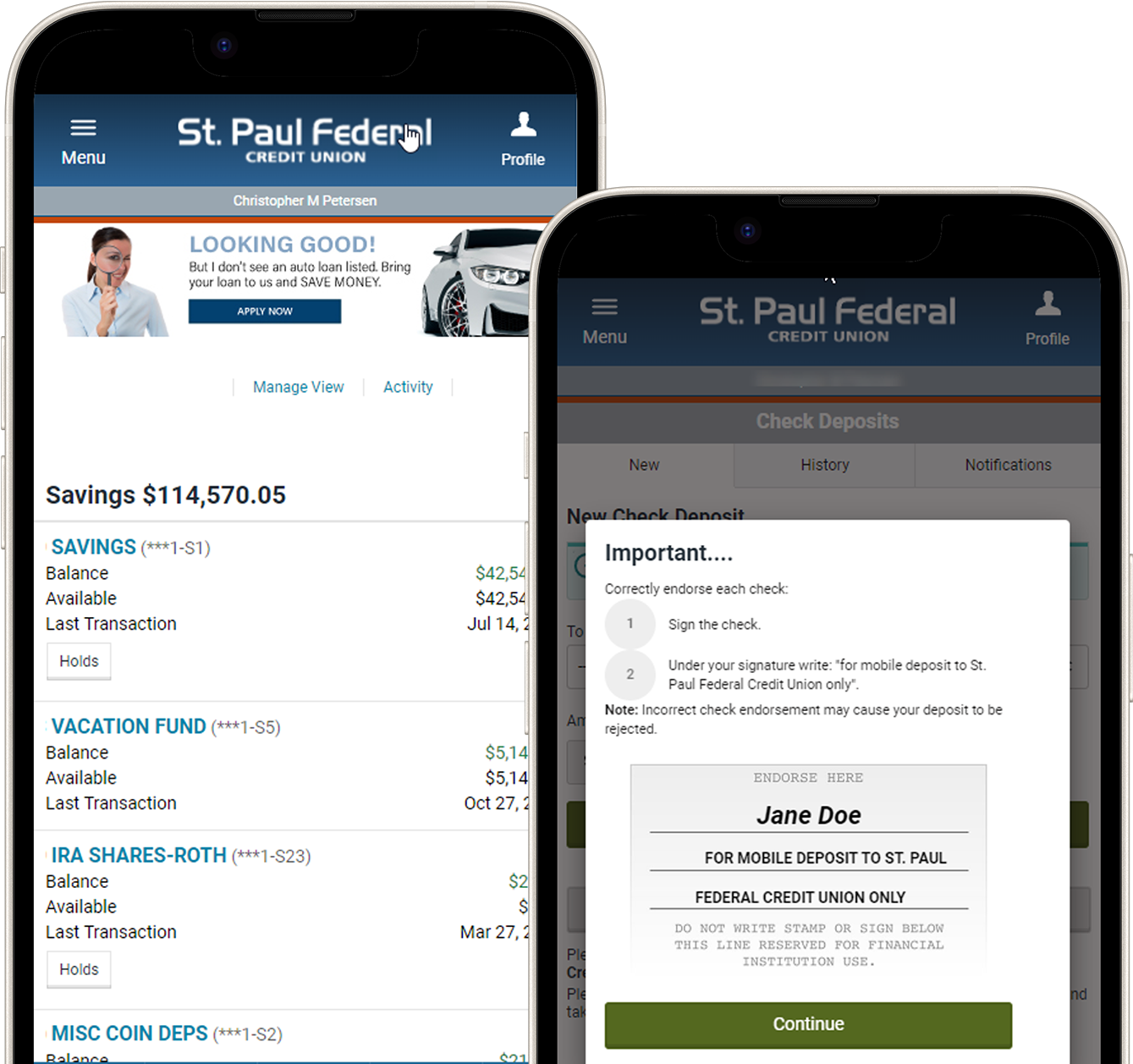

24-hour, 7-day account access via eBanking, mBanking, MARS, or our call center

Direct Deposit

Requirements to receive 4.99% APR* interest

Make at least 20 debit card purchase transactions per statement cycle (Average purchase transaction of $5.00)

Earn 3.99% APR on balances up to $15,000 when you make 40 debit card purchases per month.

Earn 4.99% APR on balances up to $20,000 when you make 60 debit card purchases per month.

Earn 2.99% APR on balances up to $10,000 when you make 20 debit card purchases per month.

Sign up for eStatements and login to eBanking monthly

Have recurring direct deposit into your checking account (At least 2 direct deposits of $500 each from a qualified payroll or pension provider required)

1TERMS & CONDITIONS: No Monthly service fee. Maintenance and activity fees do not apply. Other fees may apply, such as overdraft fee, and insufficient funds fee. See the Account Disclosures for terms and fees that may apply. *APR = Annual Percentage Rate. APY = Annual Percentage Yield. Bonus Annual Dividend Rate of up to 4.99% will be paid on balances up to $20,000 as long as cycle requirements are met. Balances above the qualified tiers will be paid the default current rate of your respective checking account (Capital Checking account pays no dividends). If requirements are not met during statement cycle, account will function as your default checking account and earn the stated default APY. Requirements for earning the bonus dividend rate include: 20 debit card purchase transactions (excluding ATM transactions) per statement cycle to meet base bonus dividend tier, 40 debit card transactions (excluding ATM transactions) per statement cycle for the mid-level bonus tier, 60 debit card transactions (excluding ATM transactions) per statement cycle to meet the top bonus dividend tier, enrollment into eStatements through eBanking and monthly login to eBanking, and at least 2 recurring direct deposit or $500 or more from a qualified payroll or pension provider per statement cycle. Debit card transactions must be for an average purchase amount of $5.00 or more. Multiple transactions or sequences for the same or similar dollar amounts, or significant small purchase amounts, or other abusive account activity, not in normal activity patterns, may be deemed in violation of terms of this program and will subject the account holder to a six month termination of the Simply Checking Rewards program and its bonus dividend payments. After six months, the account will be reviewed to determine future eligibility. Rates, terms, and fee are subject to change at any time. Account opening is subject to approval.

2Cost of checks vary and are charged to the member upon order.